All Taxable Persons (including Free Zone Persons) will be required to register for Corporate Tax and obtain a Corporate Tax Registration Number. The Federal Tax Authority may also request certain Exempt Persons to register for Corporate Tax.

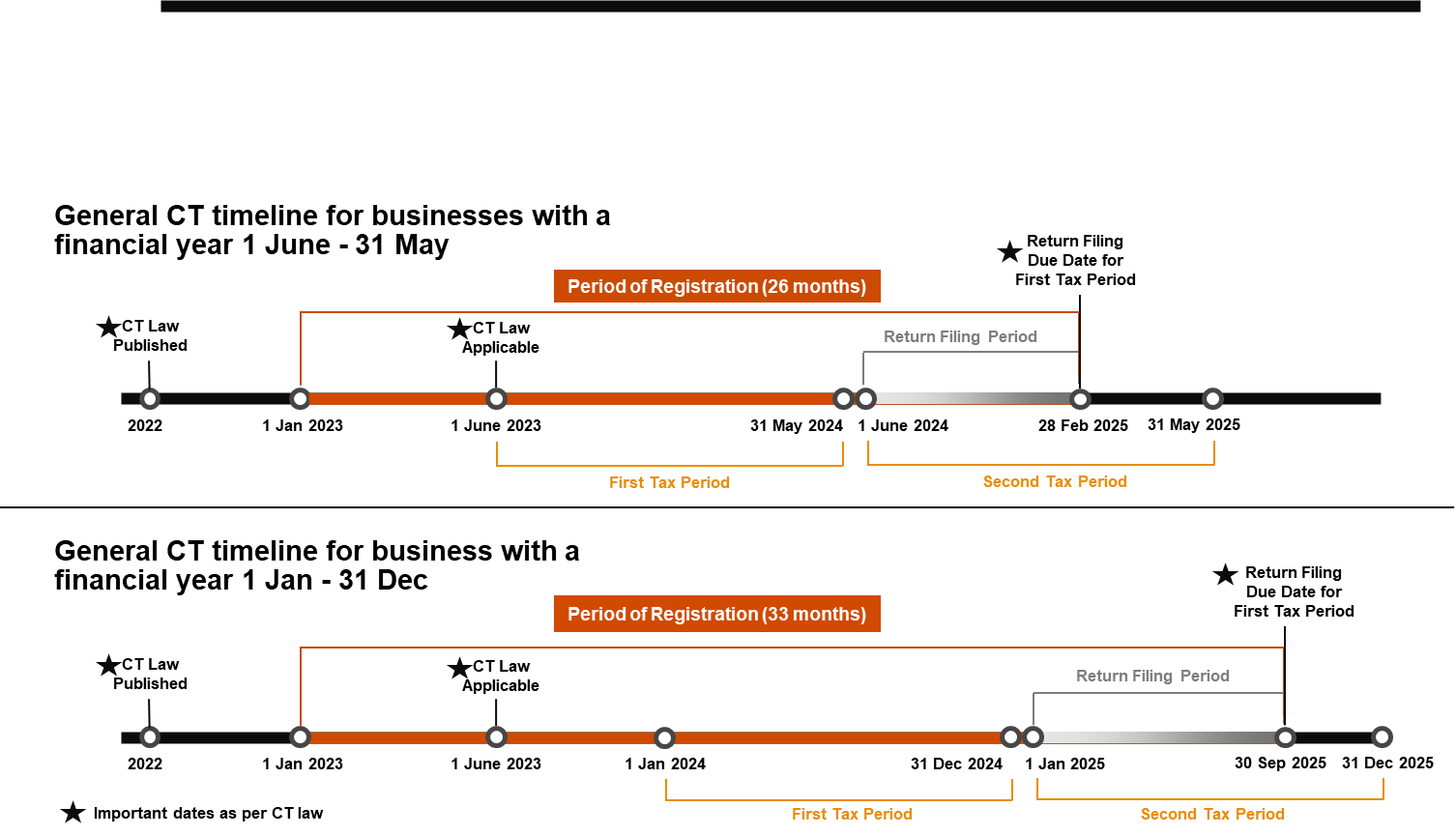

Taxable Persons are required to file a Corporate Tax return for each Tax Period within 9 months from the end of the relevant period. The same deadline would generally apply for the payment of any Corporate Tax due in respect of the Tax Period for which a return is filed.

Illustrated below are examples of the registration, filing and payment deadlines associated for Taxable Persons with a Tax Period (Financial Year) ending on 31 May or 31 December (respectively).

18.How to prepare for Corporate Tax?

1.Read the Corporate Tax Law and the supporting information available on the websites of the Ministry of Finance and the Federal Tax Authority.

2.Use the available information to determine whether your business will be subject to Corporate Tax and if so, from what date.

3.Understand the requirements for your business under the Corporate Tax Law, including, for example:

a.Whether and by when your business needs to register for Corporate Tax;

b.What is the accounting / Tax Period for your business;

c.By when your business would need to file a Corporate Tax return;

d.What elections or applications your business may or should make for Corporate Tax purposes;

e.What financial information and records your business will need to keep for Corporate Tax purposes;

4.Regularly check the websites of the Ministry of Finance and the Federal Tax Authority for further information and guidance on the Corporate Tax regime.

Need Help!

KBA experts will help you

Just contact us any time